Since this is an investment article, let’s start with some numbers:

- There are over 5 million Vacation Rental properties listed on both airbnb and booking.com, with HomeAway and TripAdvisor coming in at 2 million and 800,000 respectively.

These numbers increase year-over-year, and even if you considered that there might be significant overlap (ie. all of the TripAdvisor properties listed on the other sites) you’re still looking at a huge amount of properties available for vacationing families and business travelers.

- As of December 2017, 35.6% of consumers booked directly from Vacation Rental property owners.

This practice is however on the decline because consumers are finding it easier, more affordable and safer to book with the large listing site Vacation Rental providers. Among them, HomeAway had the biggest market share – an aspect attributed to the fact that it was the first to market. Over the last few years, Airbnb has had the biggest market growth.

- Although the market penetration of VR’s are still fairly low (2.3%), it is consistently on the rise and it is estimated to grow to 3.3% by the year 2020 where some industry experts expect them to overtake traditional hotels and accommodation.

Another study done on VR’s showed that between 2011 and 2016, the year-on-year revenue growth in the VR industry averaged 3.6%.

Studies have been done to find out why consumers are opting to stay in Vacation Rentals compared to hotels and traditional accommodation.

- 71% of consumers prefer VR’s because they present them with more space.

- 62% of consumers love the fact that VR’s usually have lower rates than hotels.

- 53% of respondents also loved the fact that VR’s had better amenities and gave them an “at home” experience.

So how do these factors ‘add up’ (pun intended) to a vacation rental – or villa holiday, self-catering rental or holiday home – being a great investment? Typically, the ‘short term’ rate that a vacation renter pays is much higher than what the same property would rent for as a long term lease. For example, a property that would rent long term for $2000 / month may easily rent for $200-$250 / night as a short term vacation rental. Even factoring in a property manager or rental manager commission, renting the property for less than half of the month – which is definitely doable with the right marketing – would achieve the same income, with the additional bonus of less wear and tear on the property.

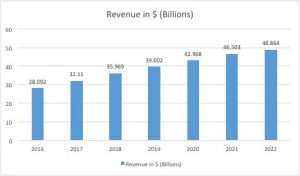

One last chart:

Revenue for the vacation rental industry in 2016 was $28 billion dollars (US). By 2018 it had grown 30% to nearly $36,000,000,000 (yes – thirty six billion dollars). Projections for 2022 show industry revenue reaching almost $49 billion dollars.

Wouldn’t you want a piece of that?